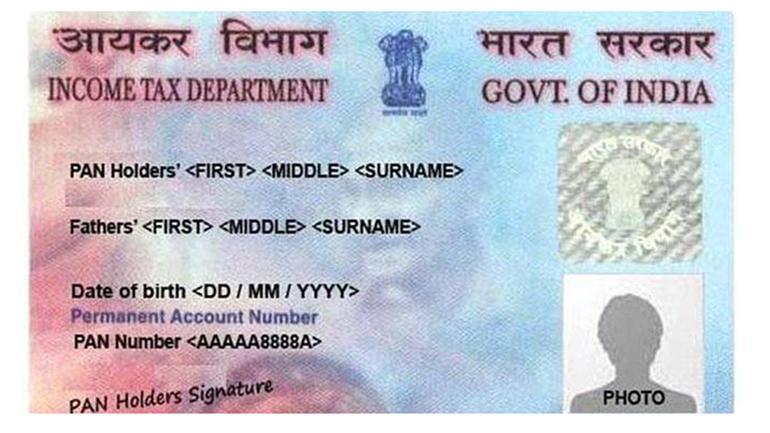

Pan Card

First of all, It is mandatory to provide PAN number or PAN Card for additional Rs.50 thousand transactions.

On November 1, this rule applies to occasions, investment, bank or any other way. He/She will also be required to provide a PAN number of additional transaction tax at a cost of 50 thousand rupees.

Those who do not have a PAN number will be able to get rid of the PAN number by filling the form number 60.

Pan leaves give a penalty of Rs 10 thousand to the provision

First of all, If the PAN number is not given then A fine of up to 10 thousand can be imposed. The below list describes where it is mandatory if the transaction cost is 50 thousand or more.

- Apply for the purchase

- Sale of vehicles

- New bank account

- Debit or credit card

- Open a Demat account

- Hotel Paying

- Investment in Mutual Funds or Debentures

- FD (Fixed Deposits)

- Loan Repayments

- Purchase of property worth more than 10 lakhs.

- Also, If you have purchased anything more than 2 lakhs then the PAN number is mandatory.

Foreign travel involved

It is mandatory to give a PAN card if it costs more than 50 thousand. Here is the list of items where PAN is mandatory.

| Jewelry |

| Foreign Travel |

| Electronics IT Purchase |

| Property Purchase |

| Vehicle Purchase |

| Clock |

| CA or Lawyers’ Fees |

| Occasional Expenses |

| Services |

PAN Card Mandatory