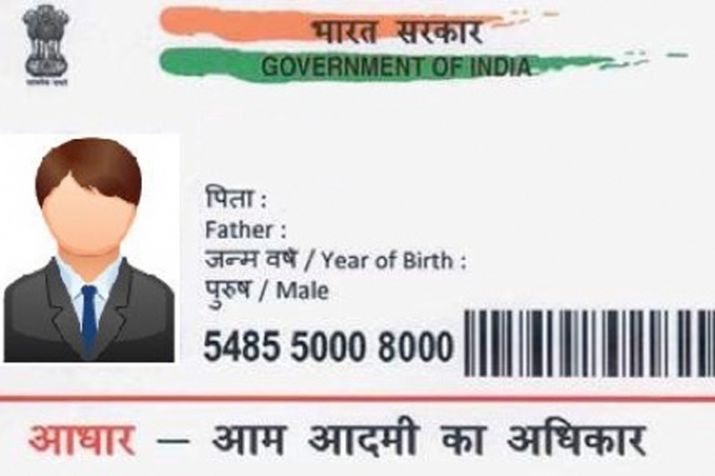

The central government has instructed to use Aadhaar card instead of PAN card for many works. The Central Board of Direct Taxes (CBDT) has created a new rule amending the Income Tax Act, 1962, after the Ministry of Finance issued a notification.

The central government has modified many sets of income tax forms. In addition, the government has assured that no change will be impacted on any person after this change in rules. You can use Aadhaar number instead of Permanent Account Number (PAN) for income tax after September 1, 2019. Earlier in the General Budget 2019, the finance minister announced that the use of Aadhaar card instead of PAN card would be valid.

The Central Board of Direct Taxes creates a new rule amending the Income Tax Act 1962

For Income Tax you can use Aadhaar number instead of Permanent Account Number (PAN).

Even without taxpayers PAN card, they can file income tax return using their Aadhar card.

Income tax return can also be filed with Aadhaar card.

The government’s decision means that from now on, if no one has a PAN card, you can use Aadhaar card instead.

For ordinary taxpayers, this means that even without a PAN card, they can file an income tax return using their Aadhar card. Aadhaar card can be replacement of PAN card.

In any financial year, a person’s income is not subject to tax exemption, he is required to pay income tax. After the new rule goes into effect, Aadhar card can also be used instead of PAN card. In addition to the income tax return, Pancard is also traded at high value at the time of the transaction.

Recent changes in the form

After changing of Income Tax Act rules under the 1962 form below form number also changed.

3AC, 3AD, 10CCB, 10CCBA, 10CCBB, 10CCBBA, 10CCBC.

Hiya very cool web site!! Guy .. Beautiful .. Wonderful .. Roxi Tristam Weiss

Thanks for the good writeup. It in fact was once a amusement account it. Valentine Pinzino

Useful information. Lucky me I discovered your site by accident, and I am stunned why this coincidence did not happened earlier! I bookmarked it. Andreas Doussan

I got what you mean,saved to my bookmarks, very nice internet site. Howard Rinn

Thank you for sharing your info. I truly appreciate your efforts and I will be waiting for your next write ups thank you once again. Minh Gallmon

Just wanna admit that this is very beneficial , Thanks for taking your time to write this. Joel Giorgi

I am regular visitor, how are you everybody? This piece of writing posted at this web page is actually pleasant. Milford Okoniewski

Thank you for your post. Really Cool.